Guaranteed stop losses work exactly in the same way as basic stop orders, although investors can choose to pay a small fee to guarantee the closing of a trade at the exact price specified. This way, if you have used a particularly high leverage in the trade, there will be less chance of multiplying your losses, regardless of market volatility. Spread betting is the most popular product on our platform, which you can use to trade an endless array of financial assets. As discussed, you must use leverage when spread betting our products, which can bring risks. This is why we offer you the chance to familiarise yourself with the platform on our demo account before depositing real funds. Below, we explore the risks of spread betting leverage in more detail.

What Is Forex And Should It Be Part Of Your Investment Strategy – Forbes

What Is Forex And Should It Be Part Of Your Investment Strategy.

Posted: Thu, 29 Jun 2023 14:27:37 GMT [source]

This increases your “buying power” and allows you to make trades using this larger amount of capital. Since leverage allows you to trade with borrowed funds, it maximises your profits as well as your losses. The higher the leverage, the greater you are exposed to the market. Leverage trading multiplies your returns whenever a trade is successful, as profits are always calculated on the full position. If a trader opens a position and the market reverses, the incurred loss would be greater than the sum of their capital. Using leverage is much more common with commodity trading than with stock trading.

What is leverage in Forex?

In other words, the margin requirement would be 1% or ($1,000 / $100,000). A margin call is when a broker requires a trader to deposit additional funds into their account because the value of their open trades has fallen below a certain level. Leverage allows traders to trade with https://forexbox.info/ more money than they have in their accounts, which can potentially increase their profits. Doubling your risk on a one-off basis could benefit a trader if they happen to get that one-off trade right. But get it wrong and a trader could end up facing a much larger loss than usual.

AAAFx Sheds Light on the Role of Leverage in Forex and CFD Trading – Finance Magnates

AAAFx Sheds Light on the Role of Leverage in Forex and CFD Trading.

Posted: Thu, 08 Jun 2023 07:00:00 GMT [source]

The majority of leveraged trading uses derivative products, meaning you trade an instrument that takes its value from the price of the underlying asset rather than owning the asset itself. Volatility of the market is quite a typical phenomenon, which mainly occurs in the crypto market. Given this, many brokers limit access to high leverage during periods of high market volatility.

Example of leverage in stock trading

At the time of writing, the EURUSD is moving about 85 pips a day, and most of that movement occurs within about a 10-hour period. So in about 10 hours, this trader could lose almost their entire account most days, if trading this way. Leverage trading can be implemented into pretty much every pre-established forex trading strategy. However, it is more effective when used in conjunction with certain trading strategies. When short-term trading is the objective, you’ll find that leverage can be a pretty potent trading tool. The following two trading strategies aren’t only popular, but they also implement leverage effectively.

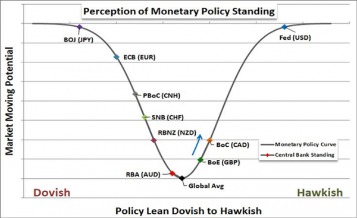

It all depends on how you use the leverage and how you manage your risk. You may have heard stories from behemoths of the industry—think George Soros—but investing is part skill, part timing and part luck. Don’t over-dream your investments, use leverage wisely https://forexhistory.info/ and make the most of your portfolio. When you’re just getting started trading forex, you’ll want to stick to trading major currencies. The USD, CAD, EUR and JPY are some of the most commonly traded currencies, and they’re also some of the most stable.

demo account

As a result, leverage magnifies the returns from favorable movements in a currency’s exchange rate. However, leverage is a double-edged sword, meaning it can also magnify losses. It’s important that forex traders learn how to manage leverage and employ risk management strategies to mitigate forex losses. Traders earn by taking advantage of fluctuations in currency pairs. The profit or loss in Forex is typically measured in pips, which is the smallest unit of price movement in a currency pair.

It is a form of security or a ‘good faith’ deposit that ensures traders can cover potential losses from their trades. The margin required by brokers is typically expressed as a percentage of the total trade size. They do this by offering high leverage and giving traders with less than several thousand dollars the ability to trade. You can’t trade $100 in any other market effectively, but with leverage in the forex market, you can.Forex brokers know these small accounts will use the leverage.

Head and Shoulders Pattern: Your Guide to Massive Profits

This is where the double-edged sword comes in, as real leverage has the potential to enlarge your profits or losses by the same magnitude. The greater the amount of leverage on the capital you apply, the higher the risk that you https://trading-market.org/ will assume. Note that this risk is not necessarily related to margin-based leverage although it can influence if a trader is not careful. Leverage involves borrowing a certain amount of the money needed to invest in something.

- Therefore, with a $10,000 account and a 3% maximum risk per trade, you should leverage only up to 30 mini lots even though you may have the ability to trade more.

- Hickerson noted that margin requirements reflect volatility in the underlying currency pair, which in turn reflects geopolitics, economics, and other factors.

- The investor technically does not own the underlying asset, but their profits or losses will correlate with the performance of the market.

- Volatility of the market is quite a typical phenomenon, which mainly occurs in the crypto market.

To help reduce risks in trading, you should plan out your trading strategy in advance. To start trading on leverage, it is advisable that a trader starts with a leverage that is lower than their maximum leverage allowance. This enables traders to keep their positions open for the full size, even if they are experiencing negative returns. Leverage is the ratio applied to the margin amount to establish how big a trade is going to be placed. Understanding margin and leverage and the difference between the two can sometimes cause confusion.